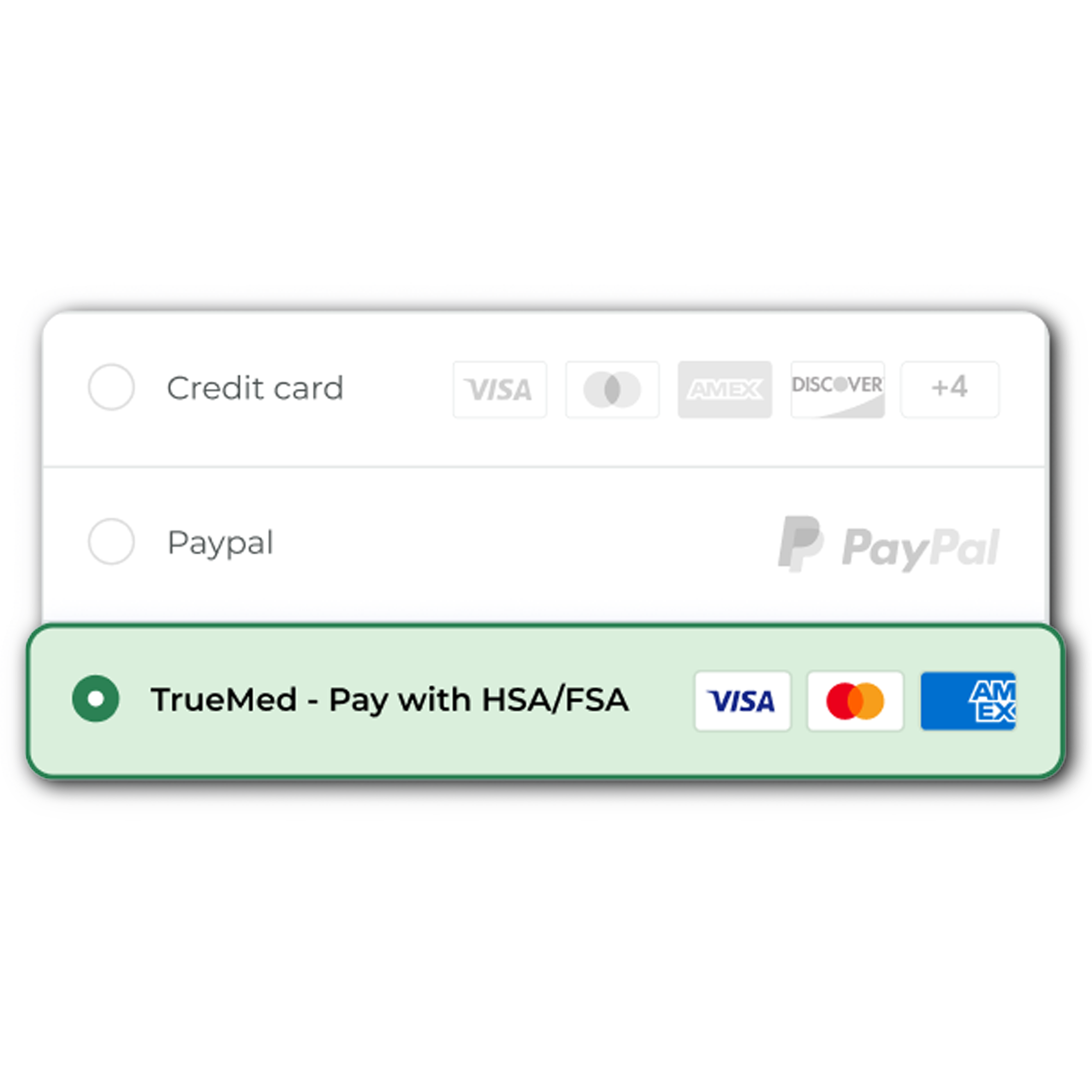

Checking out with One-Time Purchases

Checkout

Select Truemed as your payment method during checkout. Exit the Shop Pay pop-up if prompted.

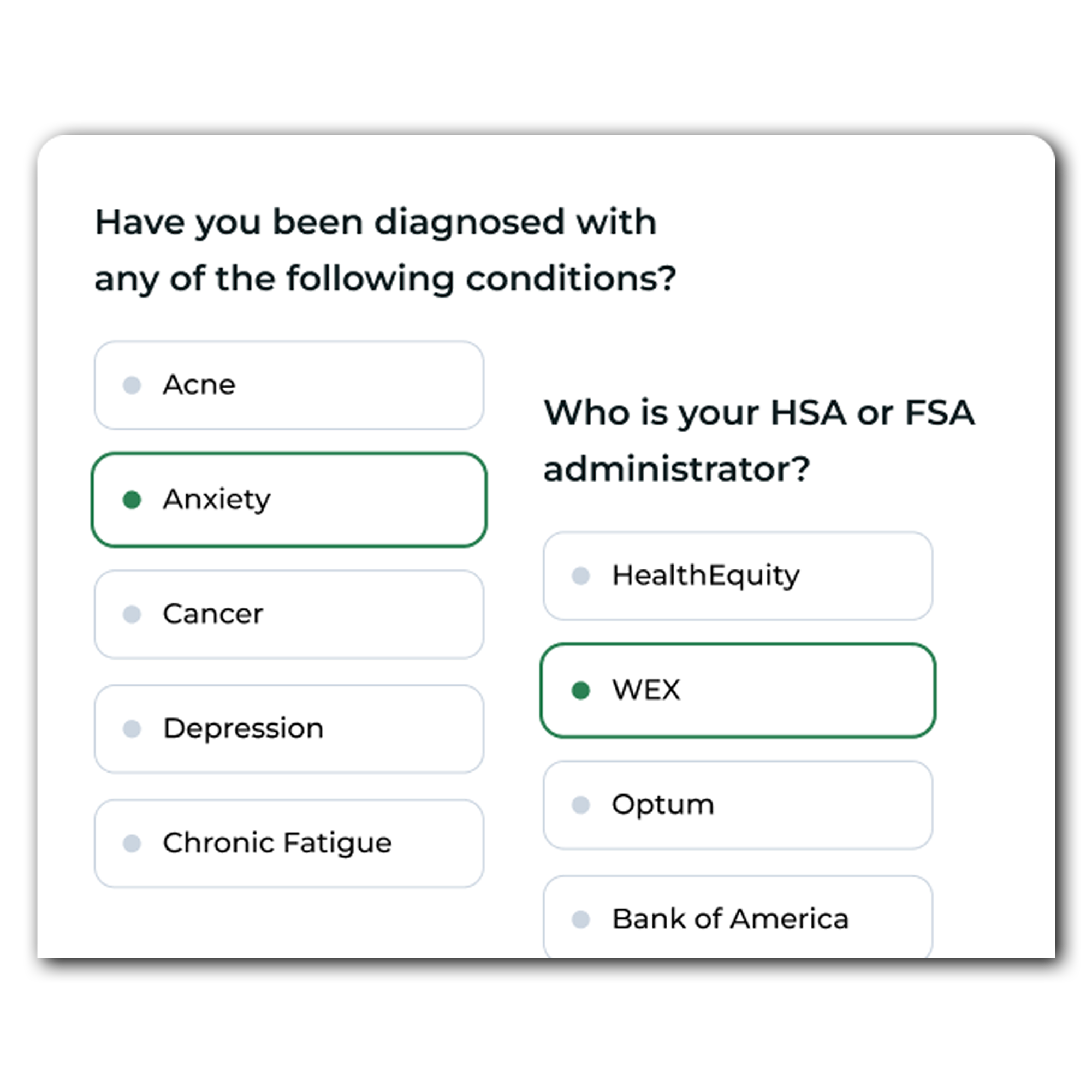

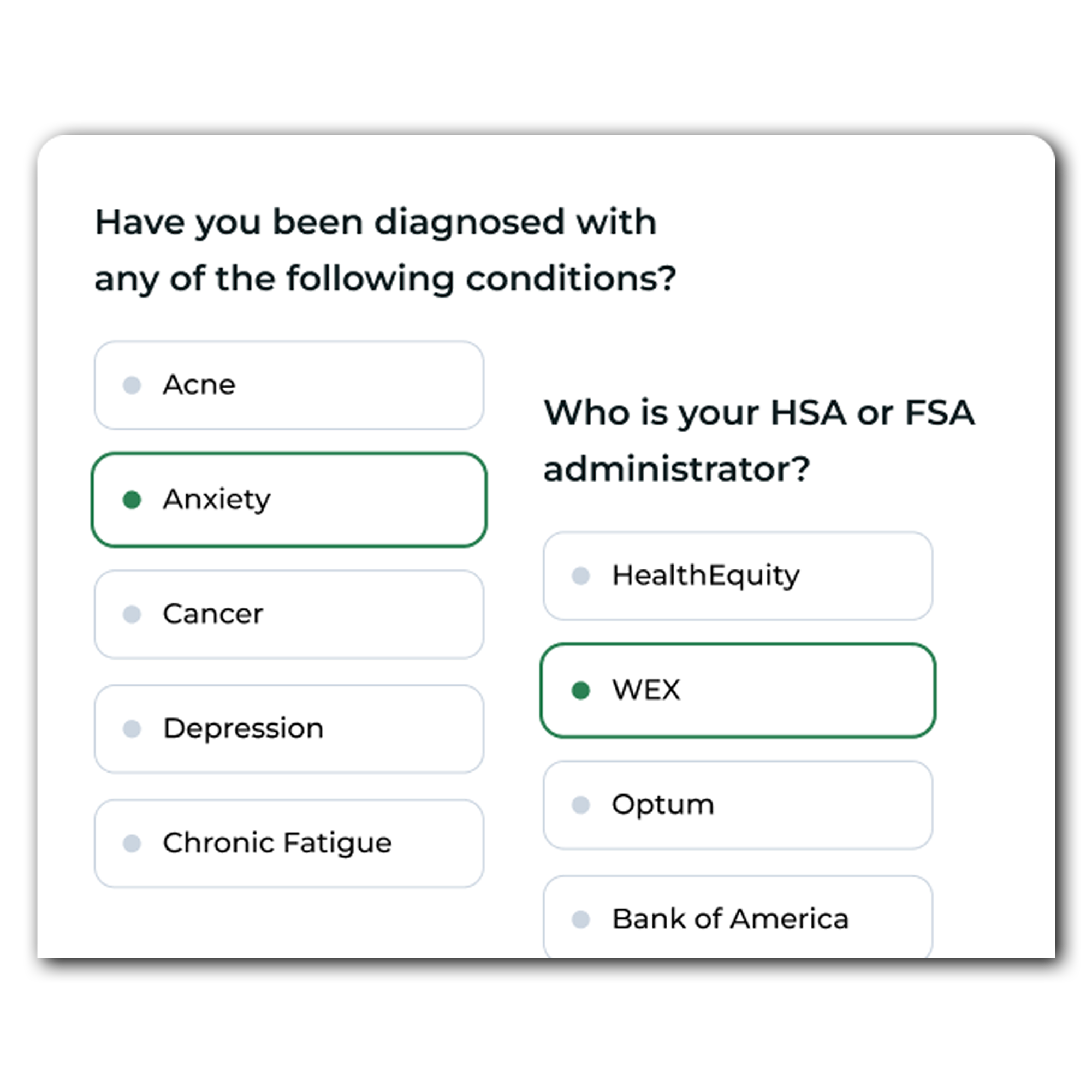

Health Survey

Take a private health survey when redirected to Truemed. A licensed provider will review your answers to determine eligibility.

Make Your Purchase

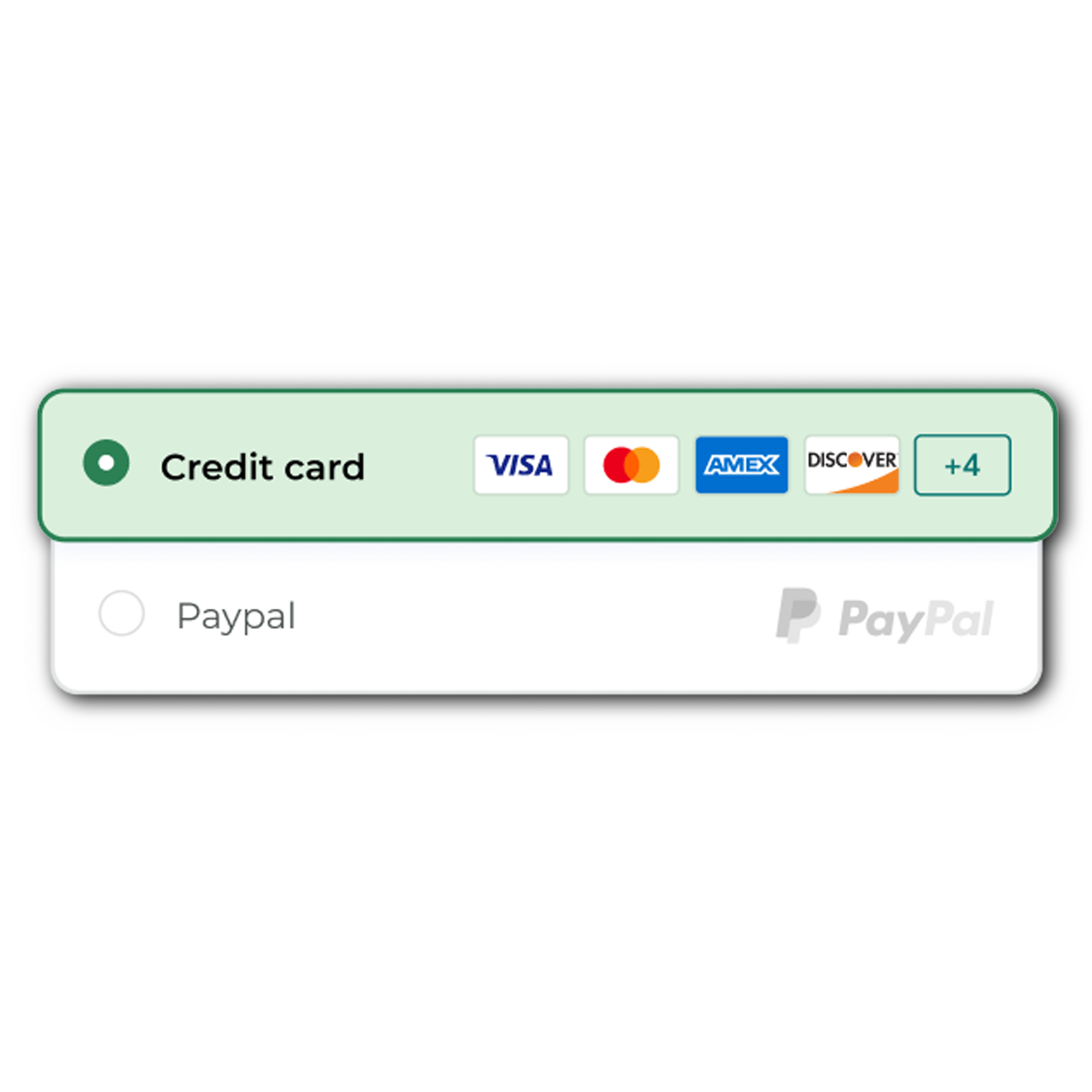

Pay with your HSA/FSA card or credit card in Truemed. If you use a regular credit card, follow the guide included with your LMN to submit your purchase for reimbursement.

Checking out with Subscriptions

Make Your Purchase

Do not pay with an HSA/FSA card during checkout. After your purchase, check your confirmation screen or email for a link to the Truemed survey.

Health Survey

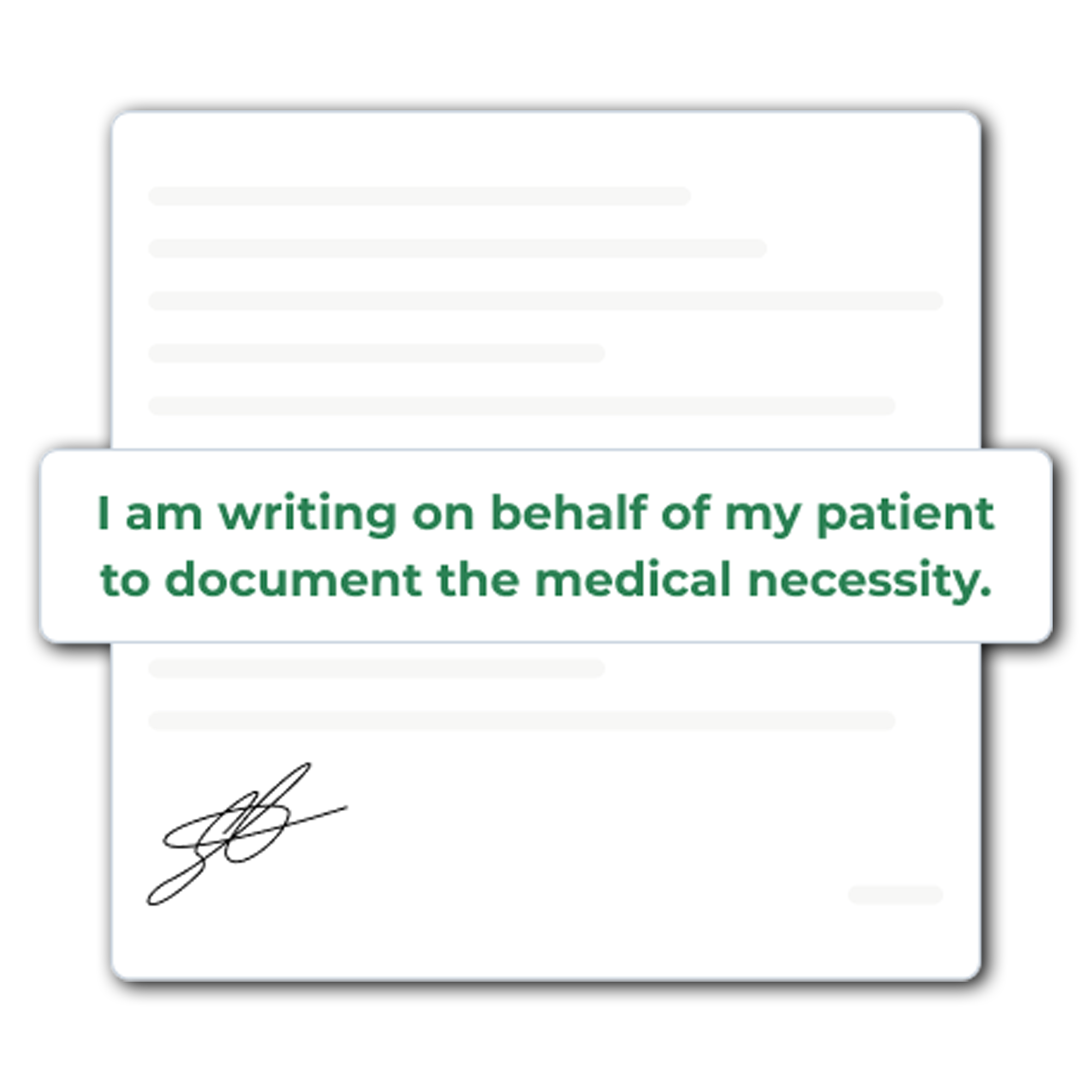

Take a private health survey. A licensed provider will review your answers to determine eligibility. If approved, you'll receive a Letter of Medical Necessity (LMN). The survey must be taken on the same day as your purchase.

Submit for HSA/FSA Reimbursement

Follow the guide included with your LMN to submit your purchase for reimbursement. Claims are usually paid out in 2-4 weeks.

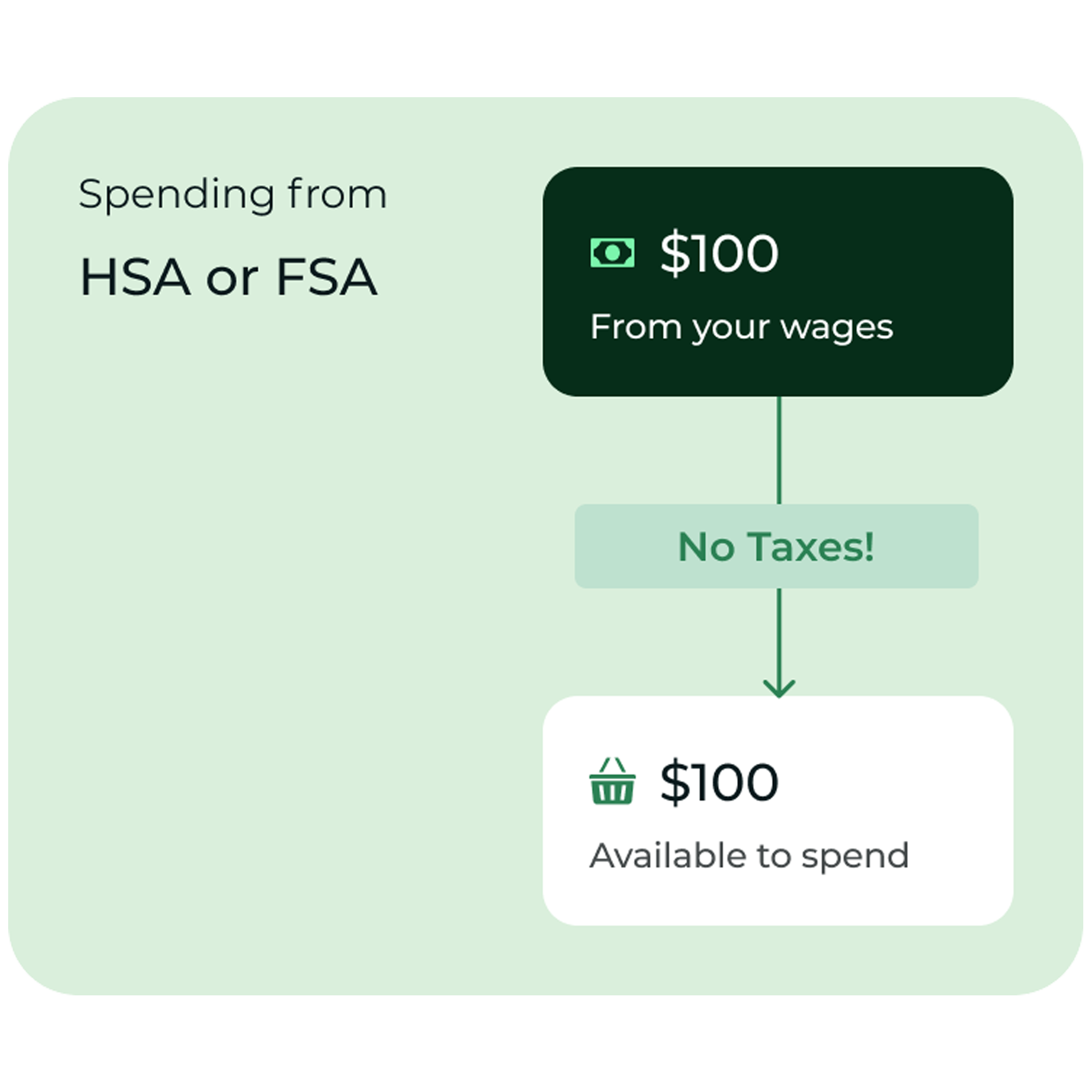

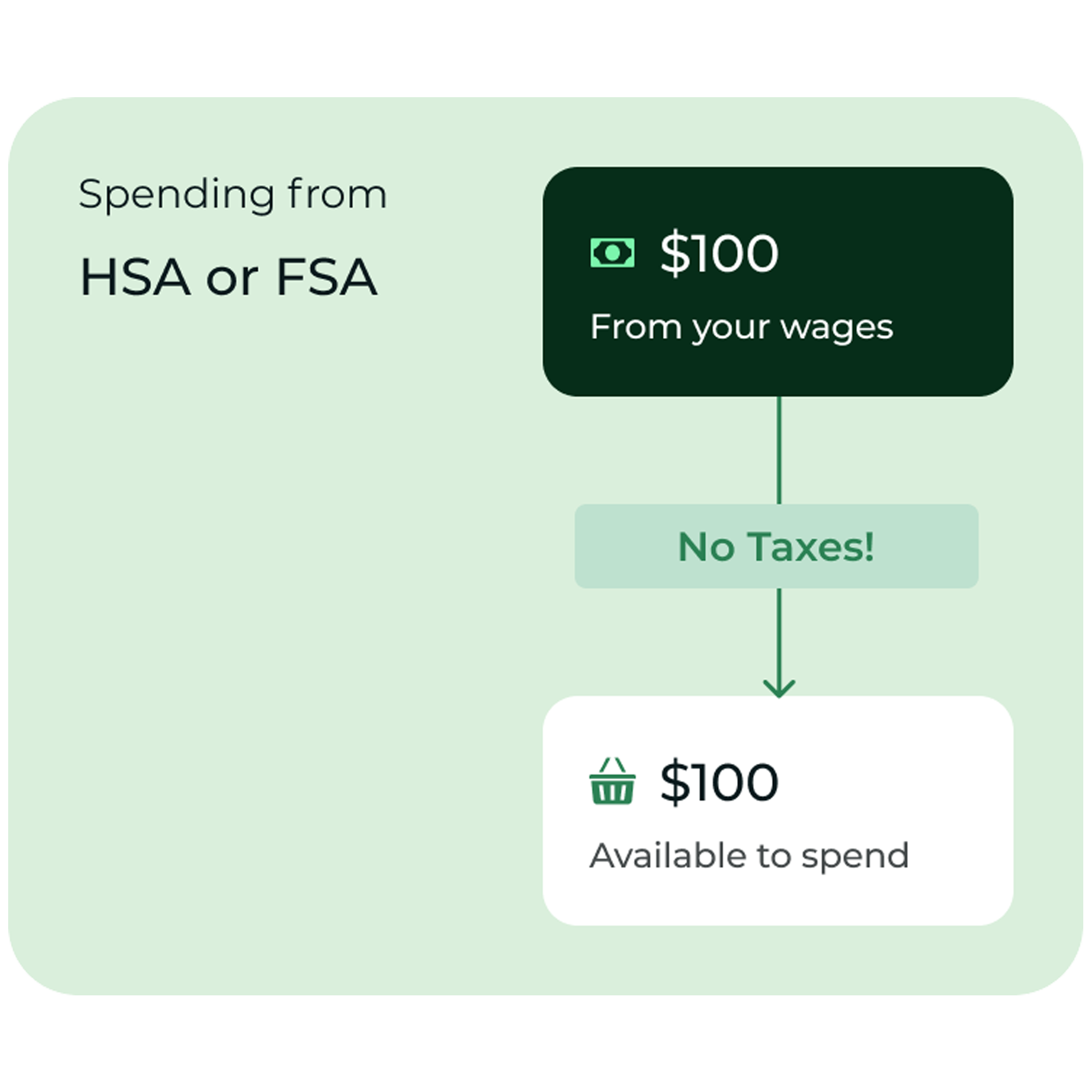

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

How does using my HSA/FSA save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.